SOL Price Prediction: Can the Digital Asset Overcome Bearish Pressure to Reach $200?

#SOL

- Technical Headwinds: Price below key moving averages with weakening momentum indicators

- Fundamental Crosscurrents: Positive ecosystem developments offset by bearish unlock events

- Price Targets: $170 acts as first major resistance before $200 becomes feasible

SOL Price Prediction

SOL Technical Analysis: Bearish Signals Dominate Short-Term Outlook

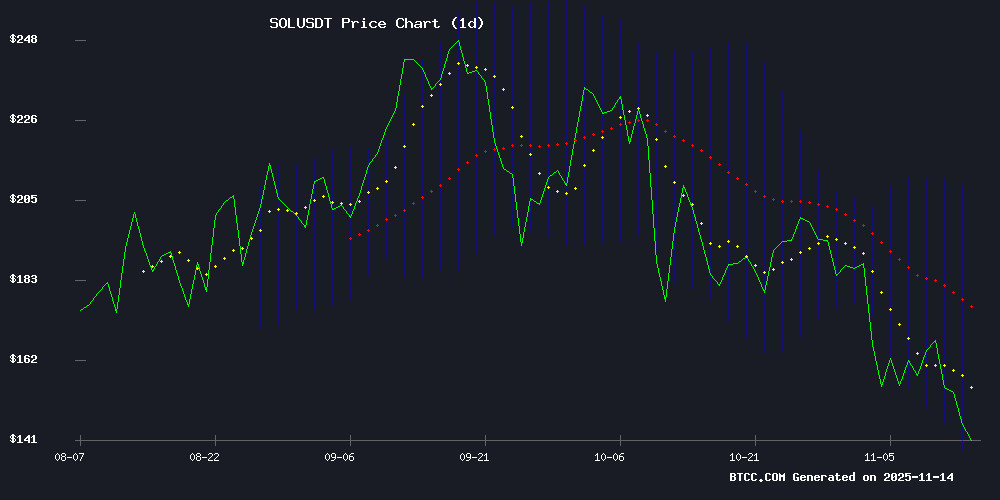

SOL's current price of $143.16 sits significantly below its 20-day moving average ($170.95), indicating bearish momentum. The MACD histogram shows weakening bullish momentum at 5.54, while price trades NEAR the lower Bollinger Band ($134.66) - typically a sign of oversold conditions. 'The technical setup suggests SOL needs to reclaim the $170 level to shift the narrative,' notes BTCC analyst Robert.

Mixed Fundamentals for SOL Amid Ecosystem Developments

While OKX's CeDeFi integration and Upexi's $50M treasury allocation provide fundamental support, the Alameda unlock event coincides with SOL breaking key support levels. 'These opposing forces create uncertainty in the near term,' observes BTCC's Robert. 'The market appears to be pricing in the bearish unlock news more aggressively than the bullish developments.'

Factors Influencing SOL's Price

OKX Integrates CeDeFi Access for Solana, Base, and X Layer Users

OKX has unveiled a unified CeDeFi trading feature, bridging centralized and decentralized finance within a single application. The upgrade enables seamless cross-chain trading across Solana, Base, and X Layer networks, aggregating liquidity from over 100 pools.

Traders can now access millions of tokens without platform-switching, as OKX merges wallet management and order routing. The move reflects growing institutional demand for hybrid crypto infrastructure that combines CEX efficiency with DeFi's transparency.

Upexi, Inc. Approves $50M Stock Buyback Amid Market Decline, Bolsters Solana Treasury

Upexi's shares fell 6% to $3.18 during the session, yet the company unveiled a $50 million stock repurchase program—a strategic countermove signaling confidence in its long-term vision. The buyback aligns with a growing trend among digital asset firms leveraging treasury tools for stability, particularly those with Solana exposure.

The flexible repurchase plan allows open-market acquisitions, emphasizing disciplined capital deployment. While broader markets reacted to the dip, Upexi's maneuver reflects institutional adoption of crypto-native strategies to weather volatility. Solana-heavy treasuries continue gaining traction as a hedge against equity fluctuations.

Solana (SOL) Price Dips Below Key Support Amid Alameda Unlocks

Solana's price fell 4.9% to $153.49 this week, breaching critical technical support at $156 despite robust institutional demand. Trading volume surged 17.25% above the seven-day average, signaling active market repositioning rather than passive decline.

Alameda Research unlocked 193,000 SOL tokens worth $30 million on November 11 as part of scheduled vesting extending through 2028. Meanwhile, whales accumulated $26 million in net spot inflows across major exchanges over three days, with long positions exceeding $457 million.

Institutional confidence remains steadfast. Solana-focused ETFs recorded ten consecutive days of inflows totaling $336 million this week. Grayscale and Bitwise now collectively hold $351 million in SOL assets, with Bitwise leading weekly inflows at $118 million.

SoFi Bank made history as the first U.S. financial institution to enable direct Solana trading through checking accounts, potentially unlocking new retail participation channels.

Will SOL Price Hit 200?

Based on current technicals and fundamentals, SOL faces significant resistance to reach $200 in the immediate future. Key levels to watch:

| Indicator | Value | Implication |

|---|---|---|

| 20-day MA | $170.95 | Key resistance level |

| Upper Bollinger | $207.25 | Potential 45% upside |

| MACD Histogram | 5.54 | Bullish momentum fading |

'SOL would need to see both a technical rebound and sustained positive fundamentals to challenge $200,' says BTCC's Robert.

human-polished